Austin, TX Homestead Exemptions: 2023 Guide

Jul 23, 2023

For homeowners in Austin, TX, homestead exemptions can provide both property tax relief and legal protection for their investment, making understanding the exemption process important. In this guide, we will explain how these exemptions work to help you take advantage of their benefits.

Short Summary

- Understand Texas Homestead Exemptions to benefit from financial savings and protect one’s home.

- Eligibility criteria must be met, followed by an application process prior to the stipulated deadline.

- Property tax reductions are available through homestead exemptions, local option exemption and optional percentage exemptions for eligible homeowners.

Understanding Texas Homestead Exemptions

Homestead exemptions are an important tool for providing property owners with tax relief and protecting their home from certain creditors. By learning about the residence homestead exemption, as well as associated property tax deductions, you can save money while securing your asset.

To examine these terms more closely. A general residence homestead exemption allows homeowners to declare part or all of their real estate exempt from ad valorem taxation by county governments and some other entities (like school districts). Similarly, there are various opportunities available in order to qualify for specific discounts on one’s total annual property taxes, something many believe is invaluable when living under the burden of ownership costs.

General Residence Homestead Exemption

An individual who owns a separate structure, condominium or manufactured home located on owned or leased land can qualify for the general residence homestead exemption if it is their principal residence at the start of the tax year. This will reduce taxable value and property taxes while also giving creditors certain protections. To apply for this exemption, you must submit an online application to the appraisal district where your property is located. Alternatively, download, print and mail in your application too.

Property Tax Exemptions

Property taxes can be significantly reduced through different types of exemptions available in Texas based on factors like age, location, disability or veteran status. Known as the general residence homestead exemption (RHE), these tax exemptions are applied to county and school taxes along with local option and optional percentage exemptions. To get the most savings from property tax reductions, it is important that you understand eligibility requirements for each type of RHE exemption applicable to your particular situation. If done correctly, this could mean a greater protection against creditors impacting your home ownership interests should they arise in future scenarios.

The Process of Claiming a Homestead Exemption

In order to be eligible for a homestead exemption, you must meet certain requirements and the application process should also be followed. This article will detail those criteria. To provide guidance on how exactly one can claim these property tax benefits.

The conditions of eligibility may vary from state-to-state, but include owning and occupying the relevant property yourself. We hope this information helps make claiming your rightful homestead exemptions easier so that you’re able to enjoy their associated advantages sooner rather than later!

Eligibility Criteria

In order to benefit from homestead exemptions, you must first meet certain qualifications such as residency, age (65+), disability status and veteran status. For example, those aged 65 or disabled before the 1st of January in any given tax year qualify for an exemption which can help reduce their property taxes. It is essential that individuals are aware of all eligibility criteria pertaining to these benefits so they may make full use of them and secure their home against creditors at the same time.

Application Process

To secure homestead exemptions, applicants must get their paperwork in before the due date either by filing it online or mailing a paper copy to the county tax assessor’s office. Travis Central Appraisal District provides people with an option of submitting applications directly at their physical location. After submission is made and processed (which typically takes around 90 days from receipt), those who don’t qualify will be given notice as well as a chance for protestation. Staying aware throughout this process is key if you wish to receive its full benefits without any hiccups!

How Homestead Exemptions Impact Property Taxes

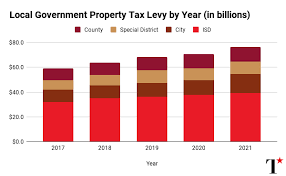

Homestead exemptions can drastically lower a property’s tax amount. This is done by cutting down the taxable value of the land and shielding it from certain creditors. Let us take an in-depth look at how this affects county, school taxes along with local option deductions and optional percentage exclusions concerning real estate taxes.

The impacts that homesteads have on one’s taxing responsibilities to their district are majorly beneficial due to lowered required payments for housing owned domestically as well as additional protection against debt claims via collateralized asset reduction strategies like these seen here making them increasingly attractive options depending upon individual situations within most jurisdictions across America today!

County and School Taxes

Homestead exemptions can help alleviate the strain of property taxes by reducing both county and school district taxation. By claiming an exemption up to $25,000 on a assessed value between $50,000 and $75,000 it is possible to lower your taxable amount for all applicable taxing authorities such as schools districts as well as counties, resulting in less money needed for your overall tax bill. Having this extra financial flexibility could allow homeowners more resources available to either invest in their own properties or use elsewhere if desired.

Local Option Exemption and Optional Percentage Exemptions

Taxpayers can take advantage of local option exemptions and optional percentage exemptions to reduce their property tax bill. These forms of relief allow taxing units to exempt up to 20 percent, minimum $5,000 value, from each qualified residence homestead exemption. They provide extra protection. To the standard general residence homestead exemption already available from the relevant taxing unit along with any other associated tax reductions.

By claiming these specific options for homeownership benefits one can effectively lower their property taxes while protecting themselves against potential creditors at the same time – it is therefore imperative for those who own a home that they understand both qualifications and requirements surrounding all applicable real estate/property related deductions or payment opportunities fully in order to get maximum savings on this front.

Key Considerations for Homestead Owners

When it comes to homestead exemptions, there are numerous things for a homeowner to take into account. It is important that they understand what advantages their owned or leased land provides and the benefits of being a surviving spouse when claiming these tax deductions. By understanding each factor involved with owning property, one can make more informed choices about its taxes and implications.

To help in making educated decisions related to homestead exemption claims, this article will dive deeper into exploring both those who own and lease land as well as looking at how taxation changes if you’re married versus single ownership of said real estate.

Owned or Leased Land

For homestead owners, the difference between owned and leased land is of great importance. If it qualifies for certain criteria, a homestead exemption may be applied to both types – when an owner has full control over his/her property as well as in case they are renting out their primary residence. Knowing these details thoroughly allows one to better assess if they can avail this form of tax relief and secure investments made on their asset or piece of land accordingly.

On the other hand, those who rent allow someone else access with temporary authority. But such people also get increased protection under specific conditions like use being declared main dwelling by that tenant-landlord duo, which would then permit them to avail of similar exemptions given above.

Surviving Spouse Benefits

For surviving spouses, homestead property tax relief and protection is a key issue to consider. If they are of the appropriate age and have an ownership stake in the home that serves as their primary residence, then eligible individuals may qualify for this exemption. With these provisions taken into account, there can be peace of mind regarding ongoing financial stability when faced with such difficult circumstances after losing a loved one. It’s important to understand what benefits come from being classified as a ‘surviving spouse’ so that you know your rights and have confidence that those will remain secure should anything happen unexpectedly.

Common Misconceptions About Homestead Exemptions

Property owners and tenants may be eligible for homestead exemptions, which can provide tax relief. There is a misunderstanding that these savings are only applicable to the primary residence. In actuality, they cannot be applied elsewhere. Many individuals mistakenly think only property owners qualify for this reduction on their taxes. Clarifying both of these misconceptions can ensure full advantage of benefits available via homestead exemptions when managing property tax liabilities.

Summary

Homestead exemptions are a must-know for Austin and other homeowners alike. With the general residence homestead exemption, local option tax deductions, and property tax reliefs available to you, you can secure your home from creditors while simultaneously reducing taxes. All while considering crucial details such as whether the land is owned or leased along with any advantages that may exist through surviving spouse benefits. These opportunities grant financial aid. To protect an individual’s most precious asset – their house – so don’t miss out!

Frequently Asked Questions

What is a homestead exemption?

Homeowners can take advantage of a homestead exemption in order to receive a tax break and subsequently reduce the amount of property taxes they owe each year. The specific value that is associated with this kind of benefit varies from one state to another, so it’s important for homeowners to understand how much their reduction will be before committing. This type of opportunity could prove quite beneficial for those seeking relief on their annual taxation bill due when owning real estate property.

How do I apply for a homestead exemption?

The process of applying for homestead exemption is straightforward. To get started, you just need to supply evidence that shows you are the owner and legal resident of your property as well as proof indicating that you meet all necessary requirements. You can either complete the form online through a local tax assessor’s website or download it, print it out and send it by mail directly to the appraisal district in charge of this matter. After submitting an application, these authorities will review everything in order determine whether one qualifies for this type of privilege or not.

Are there homestead exemption laws in states other than Texas?

Property owners must meet certain requirements to be eligible for homestead exemption in North Carolina, such as living permanently on the property for 5 years or having an income below $50,700 per year. Other eligibility is determined by age and disability status. An annual application needs to be filled out every year in order to remain compliant with this program.

A homestead exemption in Georgia offers property owners a savings of up to $25,000 by reducing the taxable value of their homes. This tax break can lead to significant reductions in taxes owed on the home’s market value.

Alaska provides an exemption from taxation on the primary residence up to a value of $72,900 with no limitation as far as acreage is concerned.

- Categories

- Client Advice